bank owned life insurance regulations

The guidance attached to this bulletin continues to apply to federal savings associations. Life insurance may not be purchased to generate funds for the banks normal operating expenses except in connection with employee compensation and benefit plans for speculation or for the primary purpose of providing estate-planning benefits for bank insiders unless it is a part of a reasonable compensation package.

Bank On Yourself Infinite Banking Whole Life Insurance Concept

Act and Part 362 of the FDICs Regulations Attachments.

. Typically the insured employee is an officer or other highly compensated employee but a bank may purchase insurance for any employee. BOLI is the acronym for Bank Owned Life Insurance. BOLI is a life insurance policy purchased by a bank or bank holding company to insure the life of certain employees.

Under most state laws there are two regulatory regimes for permanent including BOLI contracts. Risk management processes for bank-owned life insurance BOLI are consistent with safe and sound banking practices. A form of permanent life insurance owned by banks to offset the future costs of providing employee benefits.

The OCC has been the lead regulator in this area. The OCC has indicated that the gains from BOLI cannot exceed the costs they are intended to offset. The bank purchases life insurance on the lives of a group of employees such as executives and officers that participate in the banks benefit plans.

The interagency statement also provides guidance for. This tax-advantaged asset acts similarly to a bond allowing banks to offset the expenses needed for superior benefits andor informally fund executive benefits. Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and postretirement employee.

The bank pays the premium owns the cash value of the policies and is the beneficiary of the insurance. Banks are not permitted to hold life insurance in excess of their risk of loss or costs to be recovered. But if they are not grandfathered they may be surrendered for their cash surrender values.

National banks may purchase and hold certain types of life insurance under 12 USC 24 Seventh which provides that national banks may exercise all such incidental powers as shall be necessary to carry on the business of banking. Most BOLI programs regardless of contract type selected are designed with a single premium. Would compare favorable to the best credits in the banks portfolio Misperception of the duration of BOLI.

Universal life and traditional. Written consent is obtained from all individuals to be insured. How Bank-Owned Life Insurance Works.

Institutions should have a comprehensive risk management process for purchasing and holding bank owned life insurance BOLI. If the tax treatment of Bank Owned Life Insurance BOLI changes existing plans may be grandfathered. 3 Further guidance is found in section 101 j of the Internal Revenue Code and IRS Notice 2009-48.

Banks use it as a tax shelter and to fund employee benefits. The permanent policies accrue cash value which earns tax-advantaged interest. The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free.

Risk assessment and risk management are vital components of an effective Bank Owned Life Insurance BOLI program. The Office of the Comptroller of the Currency the Board of Governors of the Federal Reserve System the Federal Deposit Insurance Corporation and the Office of Thrift Supervision have issued the attached interagency statement on bank-owned life insurance BOLI to remind. Some states also have specific laws in.

With the exception of term policies occasionally used to cover a borrower while a large debt remains outstanding bank-owned policies are usually permanent life insurance like whole or universal life. Bank-owned life insurance BOLI is a form of life insurance used in the banking industry. Code 24 Seventh.

Bank owned life insurance BOLI is life insurance purchased and owned by banks. Banks can purchase BOLI policies under 12 US. Risk of loss can be eliminated if a key employee no longer qualifies due to retirement resignation or a change of duties.

Mirrors the insurance companies fixed income portfolio. It should be noted that BOLIs current tax benefits have been unsuccessfully challenged over the years. As the policys owner and beneficiary your bank harnesses unique benefits.

One based on benefits and one based on capital. Institutions should establish policies and procedures governing their BOLI holdings including meaningful risk limits. Bank Owned Life Insurance Rules and Regulations The Interagency Statement on the Purchase and Risk Management of Life Insurance OCC 2004-56 provides general guidance for banks and savings associations regarding supervisory expectations for the purchase and risk management for Bank Owned Life Insurance BOLI.

The safe and sound use of BOLI depends on effective senior management and board oversight. There are two basic tests. In addition to conducting a risk assessment as part of a thorough pre-purchase analysis monitoring BOLI risks on an ongoing basis is important.

BOLI or bank-owned life insurance is just what it sounds like. Since the bank owns the policy the bank receives the proceeds from the death benefit accrues revenue from investment. Bank Owned Life Insurance and Tax Reform.

A life insurance policy you can buy to insure the lives of your key employees. When structured correctly BOLIs favorable assetsliabilities timing. A significant concern for banks is the credit.

Bank Owned Life Insurance BOLI National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. Banking organization insurance programs include the funding of employee benefits through purchases of corporate- or bank-owned life insurance and the transfer of insurable risks through coverages associated with risk management initiatives. Management of an institution should review the performance of the institutions.

Bank-Owned Life Insurance Life insurance is regulated primarily by the states. A general rule of thumb for banks is to avoid holding BOLI in excess of 25 percent of its capital. The bank is a direct creditor to the insurance company assets It is likely that the highest rated companies such as MassMutual Northwestern Mutual New York Life etc.

Interagency Statement on the Purchase and Risk Management of Life Insurance including Executive Summary. However if the BOLI policy is transferred for value ie the purchase of an existing policy rather than a newly issued policy the death benefit is no longer tax free unless an exception applies to the transfer. What other limitations exist to the purchase of Bank Owned Life Insurance BOLI.

The insureds are employees and the institution retains at least some interest in the death benefit proceeds. Financial institutions supervised by the Federal Reserve also engage in functionally regulated insurance.

Common Mistakes In Life Insurance Arrangements

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Alternative Data And Financial Inclusion Deloitte Insights

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Federal Register Regulatory Capital Rules Risk Based Capital Requirements For Depository Institution Holding Companies Significantly Engaged In Insurance Activities

Can Life Insurance Affect Your Medicaid Eligibility

How Non Us Citizens Get Life Insurance Visa Green Card Immigrants

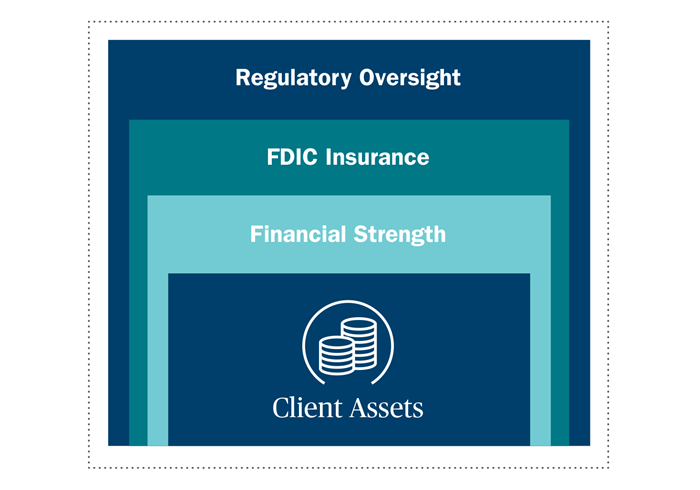

Understanding Sipc And Fdic Coverage Ameriprise Financial

Top 10 Pros And Cons Of The Infinite Banking Concept How To Become Your Own Banker In 2022

Understanding Sipc And Fdic Coverage Ameriprise Financial

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

Bank Owned Life Insurance Boli

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

Top 10 Pros And Cons Of The Infinite Banking Concept How To Become Your Own Banker In 2022

How Does Life Insurance Work Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-insurance-companies-vs-banks-separate-and-not-equal-Final-9323c943f9974aad96b2c70d6e3aa577.jpg)